|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding What Are FHA Rates Today: A Comprehensive GuideIntroduction to FHA RatesFHA rates refer to the interest rates offered on mortgages insured by the Federal Housing Administration (FHA). These rates can fluctuate daily, influenced by various factors such as market conditions and economic indicators. Factors Influencing FHA RatesMarket ConditionsThe overall health of the economy, including inflation rates and employment figures, can significantly impact FHA rates. Generally, when the economy is strong, interest rates tend to rise. Credit ScoresYour credit score is a crucial factor in determining the FHA rate you might qualify for. Higher scores often mean better rates, making it important to maintain good credit health. Pros and Cons of FHA Loans

Comparing FHA Rates to Conventional LoansWhile FHA loans offer competitive rates, it's essential to compare them with other options available. For those interested in finding the cheapest mortgage rates today, exploring conventional loan options could be beneficial. How to Get the Best FHA Rates

For those with limited income, exploring low income house loans might be a viable path to homeownership. Frequently Asked Questions

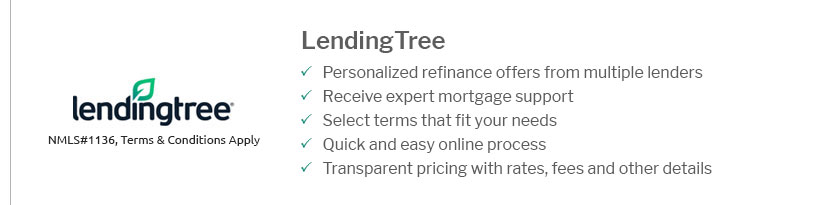

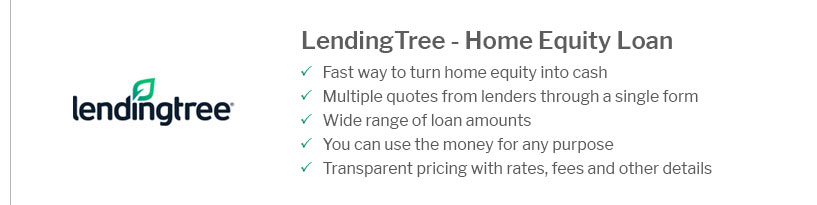

https://www.lendingtree.com/home/fha/rates/

To determine the best FHA loan lenders, we reviewed data collected from more than 30 lender reviews completed by the LendingTree editorial staff. https://www.mortgagecalculator.org/mortgage-rates/fha-rates.php

The 30-year fixed rate mortgage had an average price of 2.98%. The average FHA 203(b) loan was a tenth of a percent higher, at 3.28%. https://www.quickenloans.com/home-loans/fha-loan

FHA Mortgage Rates ; FHA 15-Year Fixed *, 5.75%, 6.739% ; FHA 20-Year Fixed *, 6.375%, 7.528% ; FHA 25-Year Fixed *, 6.25%, 7.255% ; FHA 30-Year Fixed *, 6.25% ...

|

|---|